Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

We Are NOT In A Housing Bubble!

Just the facts, Ma’am. Just the facts.

There are a lot of articles, opinions and interpretations around the idea of a housing bubble soon to come. I get it.. this massively unhealthy price growth would have any logical person thinking this has to end badly. And of course, I have my opinions, but I also have facts that you can share. This market is fundamentally unlike 2006 in that we have no speculative debt demand. That’s the key. 2006 was the era of easy lending, flexible appraising, and spec building. We were overbuilt, under qualified and overvalued.

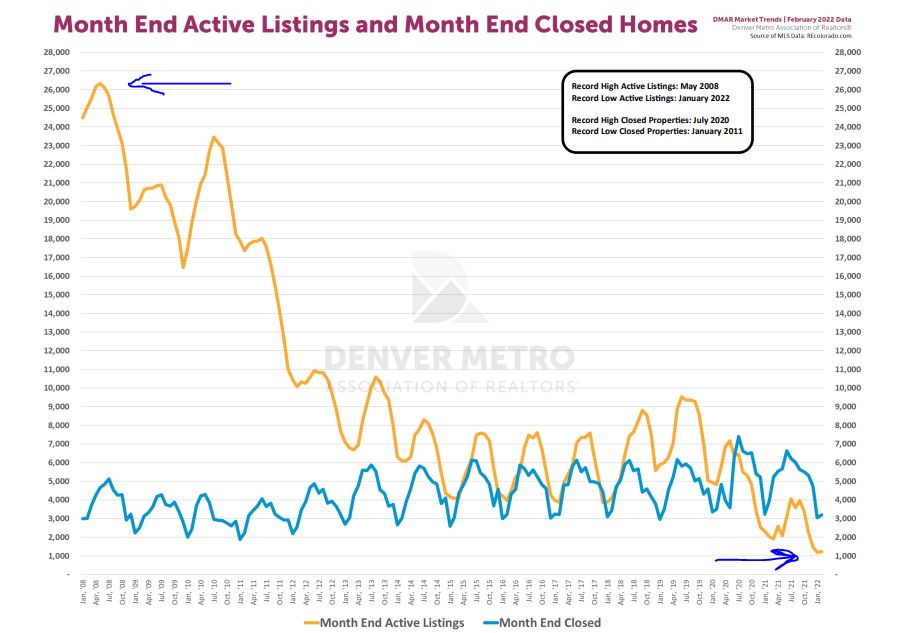

Inventory

In 2006 Denver’s inventory hit 26,333, an almost balanced market (5 months supply). One of the things we would need in order for a bubble to exist is an excess of inventory. I.e. more supply than demand. We all know real estate is hyper local. I am also seeing building production focused where builders can make the most margin…multifamily. So.. in some markets and with some product types, there maybe inventory levels that satisfy and even over supply demand. But here in Denver, especially with detached homes, inventory will take years to recover.

SNEEK PEEK… DMAR’s Market Trend Numbers will be released on Tuesday, but inventory did come up in March by 1000 units.. you felt it. BUT, demand matched it unit for unit.. proving if we had more homes to sell, we’d sell more homes.

Qualified Buyers

On average, buyers in Denver are putting 28% down and have an average 729 FICO score. With inventory tight, stronger buyers with more money down using conventional financing are winning the deal. So it’s no surprise that nationwide financed homebuyers continue to have higher credit scores than ever before. Stronger buyers with more down… this is not the speculative demand of 2006.

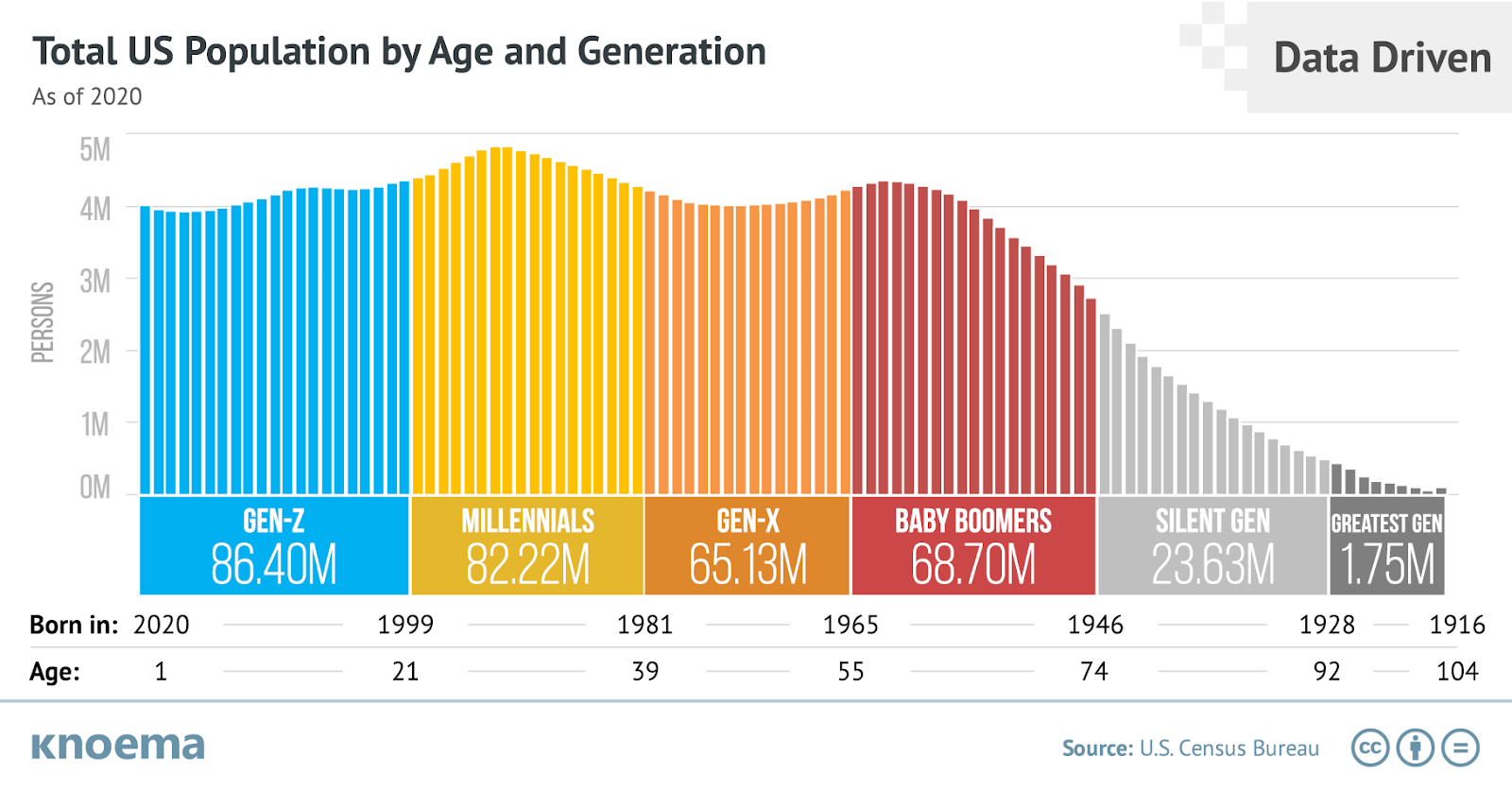

MORE Qualified Buyers

The millennials and Gen Z are enormous. They will continue to support strong demand. As their baby boomer parents age, we will also see these groups not only want to purchase, but have the ability as the largest wealth transfer occurs as a result of the last two years of home equity and stock market gains.

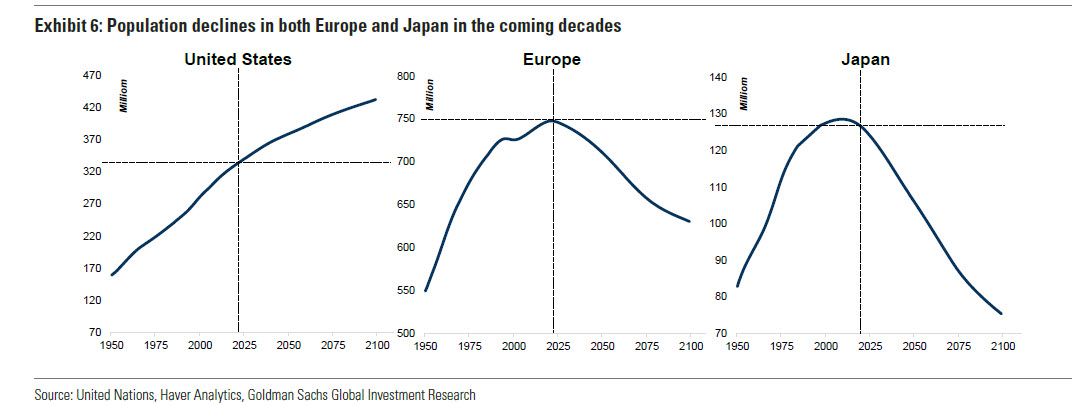

The United States is also expected to continue growing despite waning birth rates …

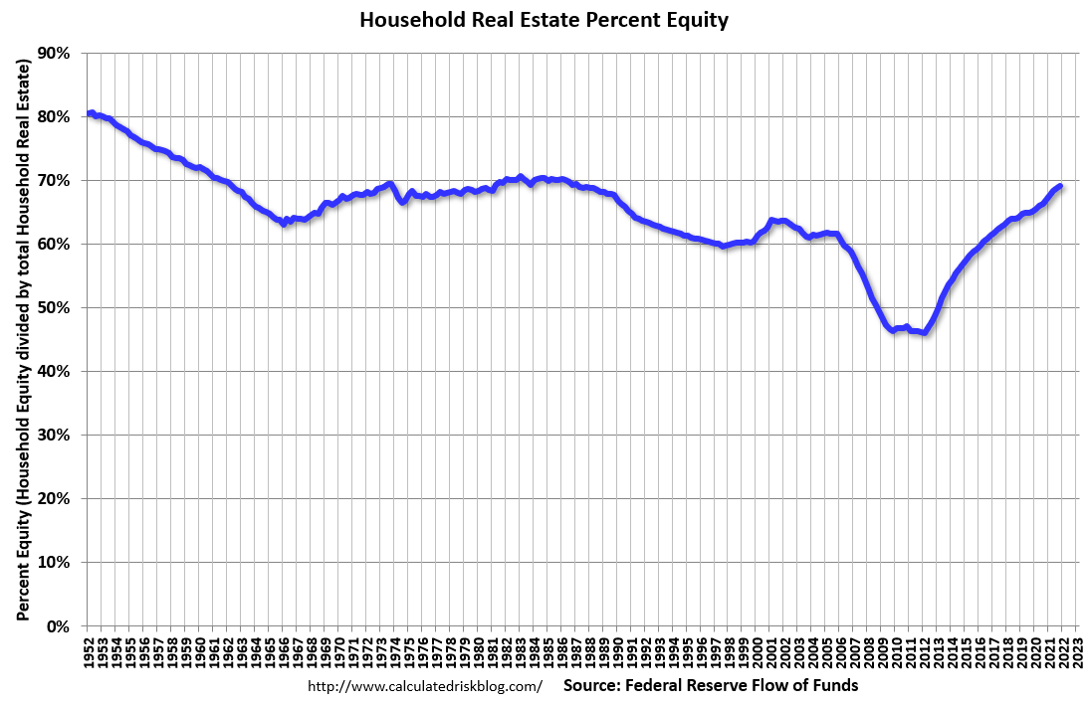

Enough Equity to Offset Price Drops

The United States is sitting on 69.2% household real estate equity including 37% of all households which are owned free and clear. Want some other eye popping stats on how strong the real estate market is…

- The national vacancy rate of households is 1.6%

- The population growth will require the construction of 2 billion new homes by 2100

- While first time homebuyers make up 33% of all home buyers; those under the age of 44 have experienced a decline in their homeownership rate due to affordability. (alluding to continued pent up demand)

- 254 homes in Colorado went into foreclosure or .01% in February 2022. They were in Jackson, Delta, Phillips Morgan and Archuleta counties (per SoFi)

- 1.9% of Denver homeowners are more than 30 days late (per CoreLogic’s most recent report)

Bottom Line… There’s Still No Housing Bubble

As more inventory comes online with the spring season and interest rates rise forcing some buyers to make hard choices, more people will come out saying the market is slowing down and prices will drop. There simply isn’t enough inventory and speculative demand to give truth to these statements. There could be some price reductions as buyers become more picky about what and where they live.

Based on the facts Denver’s real estate market is going to maintain a steady growth for years to come. The insatiable demand and equity gain alone are almost enough to fight the housing bubble notion. And you and I need to help our clients break through the challenge and frustration of getting under contract in today’s hot sellers market. This just might be our most important job!