Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

The Fed Pulled Their Pants Up

The Fed had their meeting this week and Powell not only increased the Fed Rate for the first time since the pandemic, but hinted towards quantitative tightening at the next meeting. The Fed now needs to hurry up. Inflation is on a runaway train and without price stability, we can’t have a sustained period of maximum employment and then both of his mandates just flew out the window!

TWO Mandates

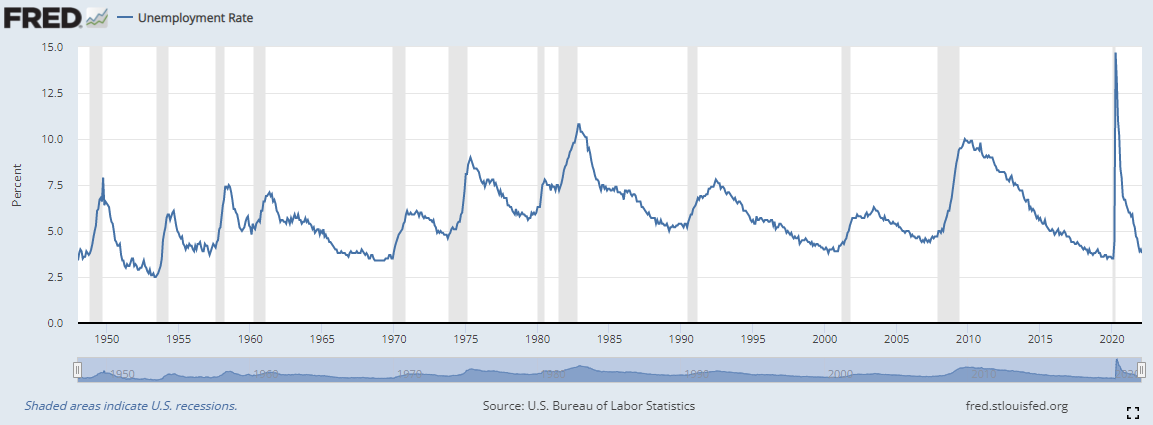

That’s it. The Fed in all it’s wisdom and power, throwing the economy into recessions and expansions, is trying to control two things.. the cost of everything and jobs for all who want them. Jobs.. check! We achieved 3.8% unemployment which is just off the historical 3.6% unemployment target. This while having 10.3 million job openings. The economy has been stimulated into a revival giving American’s the ability to find their passion, start a business, create a gig. Meanwhile, businesses are trying to keep up with demand and posting positions while raising wages.. up 5.8% in Denver. The participate rate is rising as more people come back to work as the PPP and stimulus funds are spent. There was talk of the Great Resignation… even 55+ workers are coming back. (chart in Friday’s market update)

So while the Fed finished quantitative easing (last purchase was March 15th); is increasing the Fed Rate (.25% this week); and kicking off quantitative tightening (i.e. the roll off of their balance sheet), they need to make sure they watch unemployment. Higher short term interest rates limit business reinvesting and can lead to higher unemployment. When unemployment hits the bottom and turns up as businesses who were looking to hire are now laying off; the recession has begun. This is evidenced in the chart below. See every recession begins with an uptick in unemployment. It is not a leading indicator, it is the starting line gun.

Rates Settled In With The 0.25% Increase

While the markets reacted first to the comments of the quantitative tightening with the 10-Year rising, for the two days that followed, the 10-year settled into a sideways move allowing the 30 yr fixed to drop slightly on Friday. The 10-Year Treasury finished the week landing at 2.15%, meaning rates still above 4%.

How high will rates go?

Russia is not done invading Ukraine. Supplies such as wheat, corn, gas, oil, coal, neon, steel, and more will continue to strain inventory. The PPI (wholesale inflation) is at a whopping 10%. CPI before the Russia conflict was a high 7.9%. PCE (the Fed’s preferred measure of inflation) is 6.06%. These numbers will continue to go up before they come down. These indicators were expected to peak in March due to the pandemic induced supply chain issues. But new global developments will push prices up further and spur American companies like Samsung who is developing their own $17 billion dollar microchip plant in Texas.

While the Fed is trying to fight inflation, expect a lot of volatility in rates. Rates will improve on Fed rate hikes, get higher on worsening developments in Russia, get higher with quantitative tightening, get lower on peace talks, and get lower still in a recession.

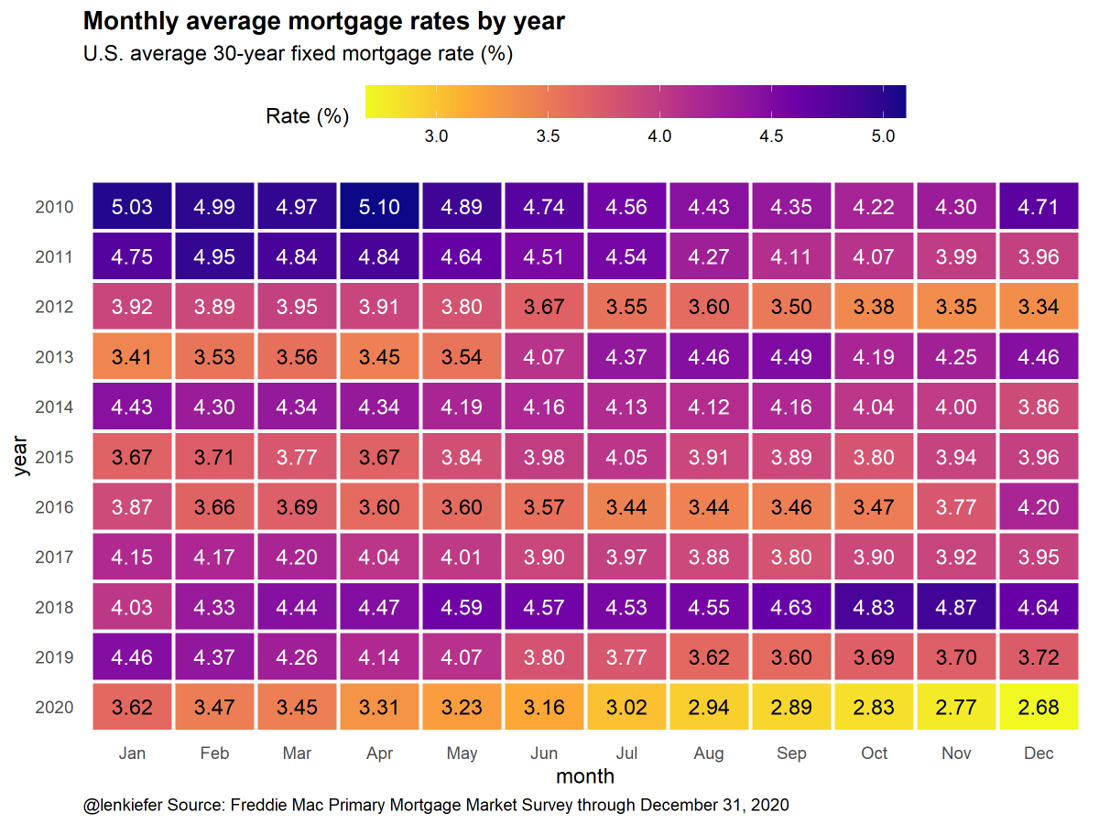

DO NOT let your buyers wait to buy on the dips. Robinhood investors love that strategy. But homebuyers only loose! They lose today’s prices and can easily refinance when rates do dip, because as rates go.. we are still at historical lows!

Call me, it’s that easy