Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Stay Calm. Yes, Interest Rates Are Rising.

I was coaching a newer loan officer this week who was anxious and stressed over the rising interest rates. Trying to lock everyone in and calling everyone in a panic. This is EXACTLY what you do not want to do I told her. Yes, we want to lock our clients in on the best rate/product/solution available. But the moment we call them panicked, they feel that. They loose confidence in the solution. They might even choose to back out or keep renting.. the worst decision they could make when rents are going up 15.5%!

Walked Uphill in the Snow. Both Ways.

It’s not even possible.. but buying your first house with a rate of 18% was, as the all-time high was 18.63% in October 1981. People buy homes. Life happens. Babies are born, jobs secured, jobs transferred, married, divorced, remarried. The walk happens.. whether it’s snowing both ways, one way or sunny all the way. The driving difference whether is a calamity or a cavalcade is mindset. It’s YOU and ME partnering together to stay calm and to keep our clients engaged, excited and positive about their options. Yes, rates are going up. Then at some point, they will come down .. when the Fed pushes us into a recession.

Don’t be afraid of a “recession”. Out of all the recessions only the last one in 2007 and one in the 1960s, did home values decline. Typically, interest rates go down in a slowing economy, which keeps buyers buying in a down market. With 69.2% equity in American’s homes, 2.1% of all homes delinquent (only 1.6% in Colorado and 1.5% in Denver), inventory at historic lows, and many homeowners locked in on a 30 year fixed rate in the 2’s; our home values are not only secure but will continue to go up!

The Cost of Waiting is Officially EXTREME

We have been talking about the cost of waiting for years as we’ve been watching home prices go up and up. But now with interest rates spiking, the monthly cost is going up even faster. So you want to protect your client.. you tell them “that rate seems high” and they go off on a wild goose chase trying to find a lower rate and end up with an online lender working from a foreign city or a lender who was a refi shop with no deadlines now turned purchase lender to try to keep the lights on. Loan Availability Date.. what does that mean? Exactly!

The 10-year has been going up since March 7th. These last two days have been a snowball sell-off of the bonds pushing prices down and rates up.. seemingly without any clear connection to the headlines or data. This most recent move pushed the 10-year further away from it’s 200-day, 100-day, 50-day, and 25-day averages (see chart below) and might create a rubber band effect pulling rates a little more in line next week. However, remember.. we have very high (and rising) inflation at 10% PPI and 7.9% CPI and a Fed scrambling to react appropriately (finally). This will keep upward pressure on interest rates already rising.

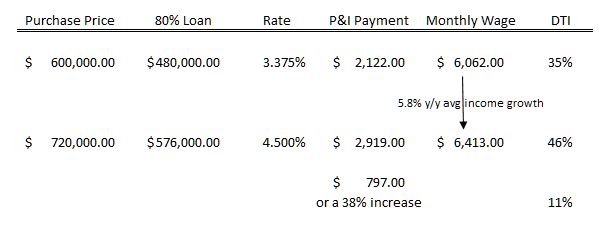

Understanding what is moving the market and how it impacts your buyers is key when things are quickly changing. As their advisors in their homeownership journey, we do not want to overreact nor dissuade them from buying but understand the strategy that works within their budget and financials. I shared the chart below on Friday’s FB Live. Highlighting the increase in prices and rates just over the last year. This example reflects a 38% increase in monthly payment directly impacting your buyer’s budget. But most people in Denver have also experienced an increase in income over the last year. In fact.. Denver was #1 on weekly income growth per ADP at a 5.8% increase. This wage increase takes the effective monthly payment impact down from 38% to 11%.

Does that make it less high? No. But it makes the rise less impactful. Turning the conversation of anxiety over rates to one which is primarily focused on payment and it’s effect on their budget.

We can not imprint our stress over the market onto our buyers. We have to be cheerleaders for their success. Educating them on why interest rates are rising, the power of real estate long term, the opportunity costs of renting, and the strong possibility of refinance options in the future.

It is markets like this where YOU and I earn the title of “expert advisor”. The real estate market is easy and everyone’s happy when interest rates are low and supply is reasonable. But, when the market starts to veer off course is when our clients will seek out experts to help guide them. That’s when we shine with fact based advice and calm confidence.