Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Starting Over: A Client Story

Home prices, rates.. there is a way..

This market has a lot of buyers struggling with what to do next as home prices and rates continue to climb. I want to share a few conversations I’ve had in the last 24 hours and how the buyer walked away with options! Because isn’t that what real estate is.. options?

(names have been changed for privacy)

Starting Over:

Jane* is 60 years old, renting, divorced, $15,000 in assets. This situation could defeat anyone… thinking did I completely miss the boat by not owning? Can I still get in this overheated market? Will I be able to retire? When you lose everything and have to start over at any age it hurts, when you are older it absolutely hurts more. This amazing woman came into my office positive, charged up for a solution, and eager to get started.. wanting a partner not just an order taker. I was all in… Team Jane!

From my perspective, we have to get Jane cash flow and with limited assets, we have to get creative. You know I love long term buy and holds, but they aren’t the answer for everything. As we get closer to retirement, we have to think cash flow. So after learning about her goals, we set up a plan of attack.

Jane is self employed and just filed an extension, so #1 is getting her draft taxes. I was able to connect her with one of our wonderful CPAs who is helping to get her filing done. With the draft taxes, we are going to look at purchase options using FHA, conventional and down payment assistance (DPA), ensuring she manages her write offs to be in the best possible situation, but managing her net income if she wants to go DPA.

Once we know the numbers for a single family or duplex, we can strategize for what’s in the market. Thinking cash flow, you want to think multiple doors. This can be a single family with a rentable basement and/or an ADU or a duplex, triplex. Given the house will also be her home, we want to make sure it’s the kind of home she wants to live in. We also know Jane does not want to househack.. so separation is key. With limited funds, we are looking at SFR with 3% down, possibly DPA, or a small multiunit going FHA so Jane can put 3.5% down.

Since Jane is also willing to move, here’s where we landed… find a small SFR or townhome with a layout that will allow her to add a separate entrance to a bed/bath/kitchenette. We know we need to go modest and look for small neighborhood pockets where opportunities still exist. Jane is going to live there for a year while finishing the basement/alternative entrance, then buy a 2nd one with 5% down and do the same thing. She knows that she needs to get in sooner than later as prices might slow down but not go down. As inventory is coming online, she is hoping to be one of fewer offers. She also knows that if we see a recession and rates drop, we will be ready to refinance her into a lower payment helping her get more cash flow.

Jane and I talked about a 10 year plan. I would love to see her in a position where she was able to purchase a 3rd home with 5% down. Then in 10 years, after her first home’s mortgage has been paid down (not off completely) through rental income as well as appreciated with the market; she can sell it to use the equity and do a reverse mortgage refinance on her 3rd home. This would get rid of her mortgage payment on her primary (3rd home) and leave her with one rental (2nd home). If she is able to design that 2nd home with multiple renters, it would not only pay down the mortgage but spin off a little cash flow. It’s all about options!

New Build Equity:

Tracy* closed on her $900k+ new build home this past January. After waiting almost a year through the building process and killing it on the sale of her townhome, Tracy was in a great position with down payment and equity on her purchase. Our call was all about how can she pull out the equity she’s gained just a few months after closing… to do it all over again! Ha… love that!

Since Tracy is in a jumbo sized loan, many jumbo lenders require 12 months seasoning. We do have some with as little as 6. You can also do deferred financing … a cash out option within 6 months, but that solution didn’t fit her situation. Tracy and I talked about her long term goals, where her and her husband wanted to be in 20 to 25 years. She came out of the gate wanting to win again, but without the goal posts, I knew her aim would be off.

Tracy has a great house in a great neighborhood. It could be easily rented.. but how high would the rent need to be on a $900K home. She could also finish the basement and get two renters.. was that customary for her neighborhood?… we talked through all of these options. We also talked about how to get the cash out. She closed in January when rates were almost 2 points lower. Is fixing her loan into a 30 year mortgage at todays rates and limited to 75-80% loan to value her best move or doing a HELOC to 90% but then being subject to rising HELOC rates. Because we know, as the Fed raises rates, so goes the bank rate, then the prime rate.. which is what HELOCs are based off of, and they can move every month.

Tracy and I decided she was going to fill out a loan application and get a CMA from her Realtor so we can layout her cash out refi vs HELOC options, as well as determine how much money we had to invest. She was also going to poke around online to see what the rents are in her neighborhood for basement apartments and even the top house. Finishing out the basement to a rentable apartment and/or mother-in-law suite will only gain her value on a resale. It would also give her more cash flow to save up to purchase additional properties.

Although we have not determined if moving is part of her solution, we have laid out a path to getting enough money to put 20% down on an investment while also building out an income stream to save for a second one. Meanwhile, creating a shared vision with her spouse on where this could take them.

So fun!

Bottom Line: There are always options to finding a solution. It could include credit repair, saving money, getting co-signers, building out unfinished basements, moving, etc. You get it. No is not an answer when helping people understand their options. 😉

9 Slides to Prove No Bubble

We all know the chances of a bubble happening are slim to none. However, Google searches and headlines still tell us that our clients are not as confident as we are. Did you miss Friday’s Market Update? I showed 9 slides demonstrating the strength of our housing market and our buyers.

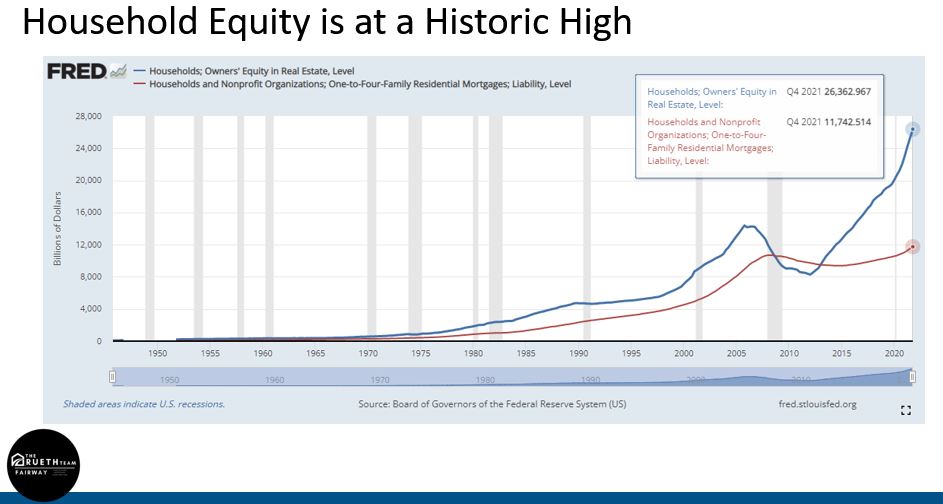

Household debt and mortgage debt are at four decade lows. With many homeowners taking advantage of the low rates and high equity we saw these past two years, consumer debt has been paid down, mortgage rates have been reduced and overall debt is low. Meanwhile household equity is at a historic high with over $38 trillion in owner occupied home values, mortgage debt is coming in at $11.7 trillion or 31% loan to value. Homeowners gained $2.6 trillion in equity in 2021 alone, giving the average homeowner $185,000 in tappable equity… game changer.

The majority of buyers today have strong credit scores and more down, with the average Coloradoan putting 27% down and having a 741 credit score.. this puts them in top tier pricing! I also showed Colorado is in the bottom 5 states for mortgage delinquencies in a month where all delinquencies hit a record low.

With these 9 slides, show your clients how strong this market is. A strong market with limited inventory will not buckle. As more inventory comes on line and interest rates go up, some buyers will leave Denver Metro and look for lower priced markets, some will chose to rent, but many will continue to jump in (as the mortgage purchase applications slide shows). What does this mean? Prices will stay strong giving those who buy the benefit of increasing equity.

BOTTOM LINE: Stay encouraged, diligent and use the creative financing options below to get under contract and into homeownership. Want to download the slides or watch Friday’s Market update? Go to our Agent Ignite FB Group to watch now.