Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Show Fewer Homes; Close More Deals

Add These To Your Toolkit

Headlines, high prices and rising interest rates are scaring buyers back up on the fence. We know that is the last place they need to be. So to help you help them, and to convert more buyers into contracts; I want to give you the tools to show fewer homes, have your buyers better prepped to make an aggressive offer the FIRST time they offer, and eliminate the possibility they’d ever consider renting.

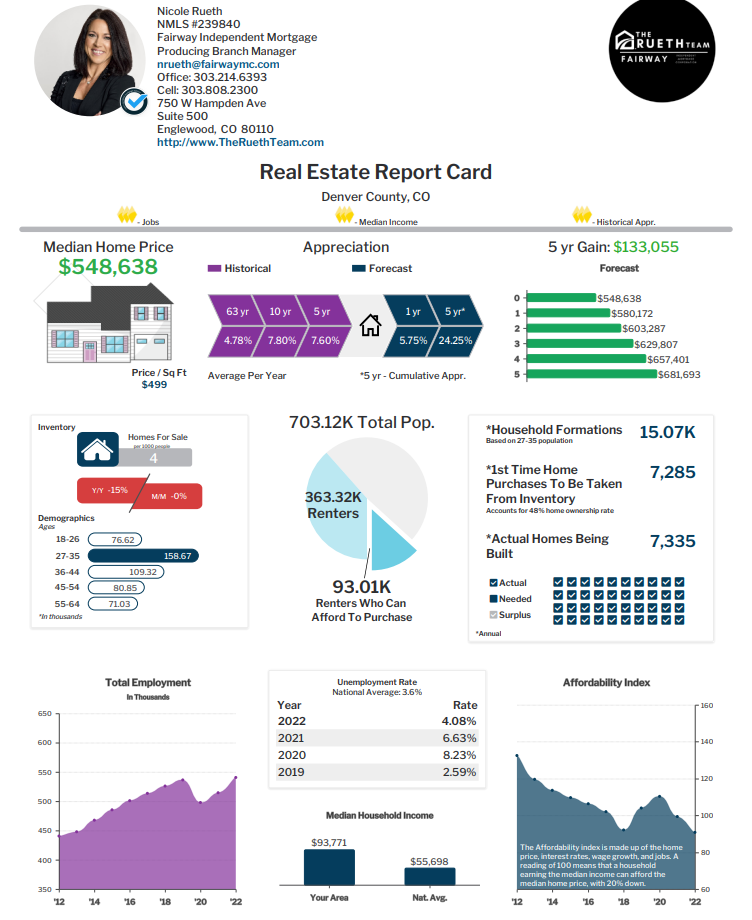

I used Denver County as an example with a $550,000 purchase price in the uploaded Buyer Conversion Bundle in our Agent Ignite FB Group.

- First, is a real estate report card – showing appreciation forecasts, supply/demand metrics in a specific area

- Second, a Buy Vs Rent Comparison – showing the overall value of buying and how it’s an absolute no brainer to BUY

- Third, is a Cost of Waiting analysis – Use to show the buyer the money they’ll “save” by ‘improving their credit’ or ‘saving for a larger down payment’ pales in comparison to the net worth increases in ownership ASAP.

- Fourth and finally, Bid over ask – Your buyers already know buying is a no brainer, use this tool to show them they can make an aggressive offer and not miss out on the home. Because while it seems the market is slowing, those homes priced and staged right are still getting multiple bids!

In markets like this – tools like these can make a huge difference in your conversions! Want to add your branding and zip code? Email Ashleigh Gutierrez at agutierrez@theruethteam.com for customization. Need them this weekend? Email me 😉

Sellers Need Love Too!

While some houses are flying off the market in 4 days, others are sticking around for a few weekends. You and I both know pricing a house right is key; but some sellers simply do not want to hear it. So what can you do to make a listing sexier? Throw in these offers for prospective buyers …

- Seller paid Temporary 2/1 Buydown. A buydown is allowed on conventional, FHA and USDA mortgage loans and is a temporary reduction below the note rate of 2% the first year, 1% the second year, after which the interest rate reverts to the full not rate. There is also a 1/0 option.

- Seller paid Discount Points. This will reduce the permanent interest rate on the loan for the buyer increasing affordability. The rate might not drop a full 2% but will give buyers a long term advantage for buying your home

- Offer to Buy Out their MI. Mortgage Insurance (MI) can cost a few dollars a month to several hundred. This could mean qualifying for that home that is just out of their reach lowering their monthly payment significantly. MI can be paid all up front or even do a split MI where the seller pays for some of it lowering the buyers payment but not taking on all the cost. This is a win-win!

- Pre-pay the buyers HOA fees for one year, two years. This will not allow the buyer to qualify for more as the lender still needs to account for the HOA, but could save the buyers hundreds a month and nudge them to put in that offer.

As your lender, I don’t want to just work for your buyers, I want to help you build your business. Need financial sheets for your listings working up these options? Let’s do it!

Real Estate is LONG Term Options!

Gabe Bodner and I just gave a presentation to the University Hills Rotary Club yesterday and WOW, it gave me yet another incredible perspective. All of the members in the room are distinguished and successful, educated and intelligent. For Gabe and I, it was an honor and a challenge. What do we share with a group of successful mature professionals about the opportunities in real estate?

We shared three things…first, our real estate market is especially strong. Inflation is high, geopolitical events are getting intense, a recession is eminent, and conversations of a housing bubble are everywhere. I understand the market we are living in and that real estate can lose value, but long term, it always goes up. With $11T in tappable equity, 40% of homes owned outright, demographics ensuring continued demand, historically low inventory, a 0.1% foreclosure rate and 1.7% delinquency rate, and 65% of mortgaged buyers having a FICO over 760; real estate will continue to provide not only shelter, but incredible opportunity.

Second, how real estate can also grow your 401k/IRA investment portfolio. In the example below, someone retiring with $1,000,000 taking only $40,000 annual distributions could be left with either $374,927 or $1,329,423. By using a retirement mortgage during the down market years, you can not only protect but grow your investment assets. I don’t know about you, but not only do I want to retire on more than $40,000 a year and want my assets to grow not deplete .. so this is a strategy I want to know!

Third, the power and joy of giving is most impactful using real estate. People talk about a generational wealth transfer from baby boomers to millennials. And I know it gives baby boomers joy to give, but seriously, baby boomers still need their money and a place to live. So what if there was a way you could provide a path for your kiddos or your grand-kiddos without it costing you anything? That is the power of real estate coupled with a retirement mortgage strategy, because real estate gives you options!