Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Interest Rates Got Better….Why?

The Dow dropped 905 points (or 2.53%), S&P dropped 2.25%, and Bitcoin dropped 8% on Friday. In case you were enjoying Thanksgiving leftovers and Black Friday sales; I wanted to share with you what happened and how it affected mortgage rates. Because I get that question a lot… what triggers mortgage rates to move. There are other factors like the Fed Funds Rate, the liquidity in the market, and inflation, but today I want to highlight supply and demand… as yesterday was EXACTLY how that works.

The Dow dropped 905 points (or 2.53%), S&P dropped 2.25%, and Bitcoin dropped 8% on Friday. In case you were enjoying Thanksgiving leftovers and Black Friday sales; I wanted to share with you what happened and how it affected mortgage rates. Because I get that question a lot… what triggers mortgage rates to move. There are other factors like the Fed Funds Rate, the liquidity in the market, and inflation, but today I want to highlight supply and demand… as yesterday was EXACTLY how that works.U.S. stocks dropped sharply on Friday as a new Covid variant found in South Africa triggered a global shift away from risk assets. This shift created demand pressure on low risk products like bonds as people did not feel comfortable in riskier products given the unknown.. the unknown of the impact this new strain will have. As people (investors) move their money out of stocks and into bonds it’s called a “flight to safety”… the safety of knowing the return of a fixed income product, even if that return is less. Once purchased the return on a bond is fixed; it does not fluctuate like stocks. However, it’s value does. So let’s double click there…

Bonds are issued at a price, let’s say $100. At that price they yield the current market rate of return, let’s say 1.50%. If people flood to the bond market to balance their portfolios and add more stability; the price of those bonds goes up. You know this as Real Estate Agents… when more than one person wants that house, the price of the house goes up.

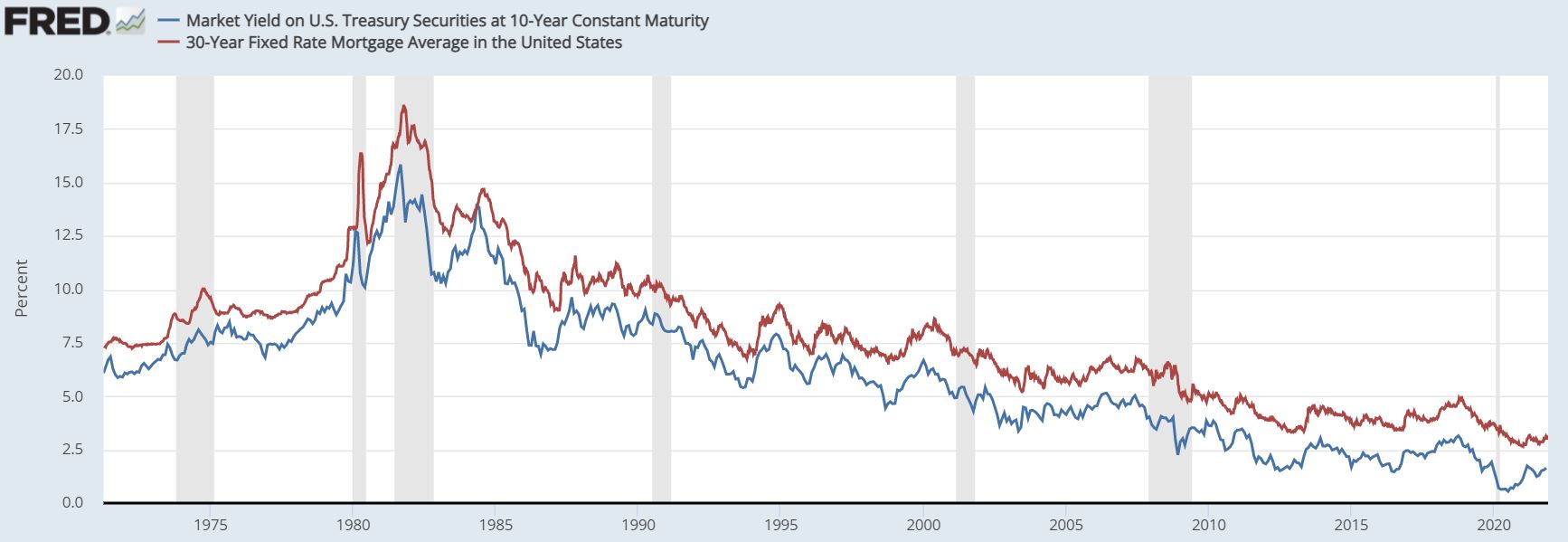

So back to our $100 bond… it’s now selling for $105 because more than one person wants it. For this example the yield for that bond when issued was 1.50% because it guaranteed $150 a year in annual payments. But now.. because the buyer is willing to pay $105 for the consistency of the annual payments that bond delivers, its rate of return is calculated on the $105 price not the $100 price. This drops the resulting yield for the $150 a year in payments from 1.5% to 1.428%. “Price” and “yield” have an inverse relationship. Yield.. is synonymous with “rate” when it comes to mortgage bonds and the 30-year mortgage rate is most closely tied to the movements of the yield of the 10-year Treasury.

See the chart above which highlights the 10-year Treasury note yield for the last several weeks. The yield dropped on Friday with the news of Omicron, the newest variant, as investors increased demand for the stability of bonds, increasing their buy price and reducing the yield by more than 15 basis points to 1.485% (right highlighted arrow).

Other examples of this supply and demand move occurred earlier in the week with yields increasing to 1.68% as investors felt confident with the news that Jerome Powell had been renominated as Federal Reserve chair. In this case they moved their money out of bonds to riskier investments knowing liquidity would continue pushing stock prices up (left highlighted arrow). In this case bond holders had to reduce their price to entice buyers.. increasing their respective yield.

As we watch the 10-year Treasury; the 30-year fixed mortgage rate typically runs 1.65% higher. (see chart below) This gap grows when lenders face a lot of risk, like we did March-May 2020. It shrinks when lenders are fighting for market share and compressing rates. But historically as the 10-year Treasury goes, so goes the 30-year mortgage rate 1.65% higher. So Friday’s drop to 1.48 plus 1.65 yields a drop from 3.28% average mortgage rates to 3.13%.

[author] [author_image timthumb=’on’]https://www.theruethteam.com/wp-content/uploads/2020/11/testimonial_image.jpg[/author_image] [author_info]Nicole Rueth has been passionately advising clients on their wealth building and home financing strategies for over 17 years. Her path has been non-conventional and it is a benefit to her clients. www.TheRuethTeam.Com.[/author_info] [/author]