Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

HELOC Rates Going Up

Powell Announcement Was Made…HELOCS Will Be Hit First

More Data. There is No Bubble

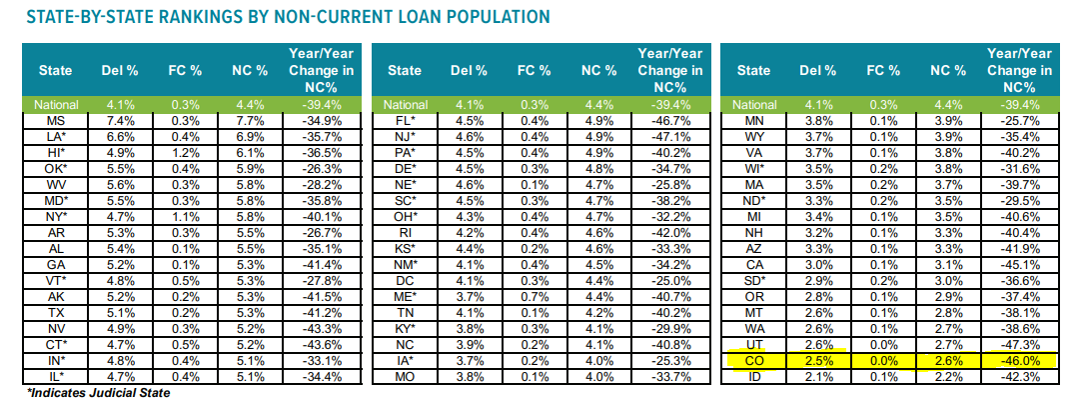

Colorado Is Ranked #49.

THIS is exactly the list we want to be at the bottom of! Colorado has only 2.5% of mortgaged loans in Delinquency, 0% in foreclosure and 2.6% non-current. Check this out…

There are 2,464,164 housing units in Colorado (per US Census)

- There is a 65.2% owner occupancy rate

- Which gives Colorado 1,606,634 homes owned (not rented)

- 37% are paid in full, so 594,454 homes NOT at risk of default

- 63% have a mortgage or 1,012,179.

- 2.5% of them are delinquent or 25,304

- only 1.4% of of our mortgaged homes have negative equity (in Denver that number is 1.2%).. so 14,170 homes at risk. The other 11,134 of the delinquent homes have enough equity to sell.

- Based on closing 5,618 homes in the DMAR area in August, we would have 2.5 months of inventory IF all of those 14,170 homes came on the market at the same time and were all in Denver Metro… which they aren’t… which means we actually have less than 2.5 months of inventory… which means…

The risk of foreclosure stressing out our housing market in sight of the birth rates 29-33 years ago, the continued net population gain, historically low interest rates, the extreme amount of equity gained (29.3% last year alone), strict qualification for buyers, and the increased favor homeownership has gained during the pandemic.. well.. I simply do not see the risk of depreciation nor a housing bubble. But maybe that’s just the color of my glasses 😉

Did you catch yesterdays market update with Megan Aller?

[author] [author_image timthumb=’on’]https://www.theruethteam.com/wp-content/uploads/2020/11/testimonial_image.jpg[/author_image] [author_info]Nicole Rueth has been passionately advising clients on their wealth building and home financing strategies for over 17 years. Her path has been non-conventional and it is a benefit to her clients. www.TheRuethTeam.Com.[/author_info] [/author]