Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Fed Rate Is Going Up 3 Times In 2022. Here’s The Impact…

Fed Rate Is Going Up 3 Times In 2022. Here’s The Impact…

Will appreciation slow down when rates go up? How much will rates go up? How will rate increases affect my buyers affordability? These are great questions and 2022 still holds a lot of unknowns. Click-bait media is talking about market normalization.. I don’t see it. At least not yet.

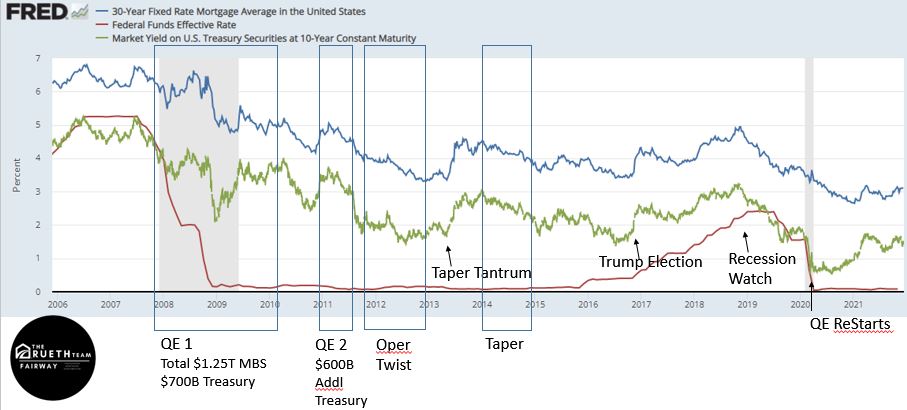

Powell announced this week the Fed is speeding up the tapering process, doubling down on cutting the amount of Mortgage Backed Securities and Treasuries. They had been buying $80B a month in Treasuries and $40B a month in Mortgage Backed Securities (MBS). In November, Powell announced the Fed would cut buying back by $10B in Treasuries and $5B a month in MBS. At that pace, it would end the tapering by June. As of this week, they doubled the monthly tapering amount, wrapping up the tapering by March.

What does this mean?

The Fed is the biggest buyer of MBS and Treasuries. Not only do they purchase both assets, they also “repurchase” them. Meaning.. if someone pays off a mortgage via a refinance, sale, or simply paying the balance in full, the Fed then uses those released funds and repurchases more. All of this creates incredible amount of demand and soaks up supply putting upward pressure on price, which in turn puts downward pressure on rates. It also creates a significant amount of liquidity in the market, which has also created a buying frenzy.. of real estate, stocks, crypto, etc.

Once the Fed is done “tapering”, they will begin raising the Fed Rate. The Fed Rate is not a 30 yr mortgage rate, it is an overnight rate used by the Fed to loan money to banks. If you’ve missed my recent Saturday blogs… I have been referencing the Fed’s move to raise interest rates and how the Fed, banks, and consumers are related since Thanksgiving, when Omicron’s discovery impacted the market in a BIG way on Black Friday.

The Fed Rate is one of the levers the Fed can use to adjust market liquidity, the cost to borrow and therefore the cost of everything… i.e. inflation. CPI came out most recently at 6.8%.. YIKES! It will go over 7% before it settles since the just released Producers Price Index (PPI) hit an all time high this week at 9.6%. PPI is the wholesale price index.. so the cost for manufactures to bring product to market. Some retails have vowed to absorb the increased wholesale prices, like Walmart and Costco, most others will pass it on to consumers.

Powell needs to raise the Fed Rate to cool overheating inflation, which will impact the economy, and in turn can impact long term rates. “Can” being the optimal word. I shared the slide below in this month’s Agent Ignite. If you missed it, the first 45 minutes highlighted all the things that is going well for us right now.. Equity is up 31%, Builders Confidence is up to 84, Housing Starts are up to the highest since 2007 for SFRs and 1974 for 2+, Retail Sales are up 18%, Savings is up $2T, and mortgage purchase applications are up 1%.

Then I presented the picture below. Just because the Fed Rate goes up or down, the long term rates, (i.e. the 10 year Treasury and the 30 year mortgage rate) might not. In fact, right before this pictures timeline, I showed another slide with the Fed Rate going up from 1% to 5% and back down to 0% from 2004 to 2009.. and the 30 year fixed rate stayed between 5.25% and 6.5% during that entire period of time. The economy, political decisions and inflation expectations affect long term rates; and right now the economy is revving its engine chopping the bit on things to spend money on, while twice as many jobs as job seekers will continue to put pressure on employers and wages. This is leading to high inflation expectations which will force long term rates to go up.

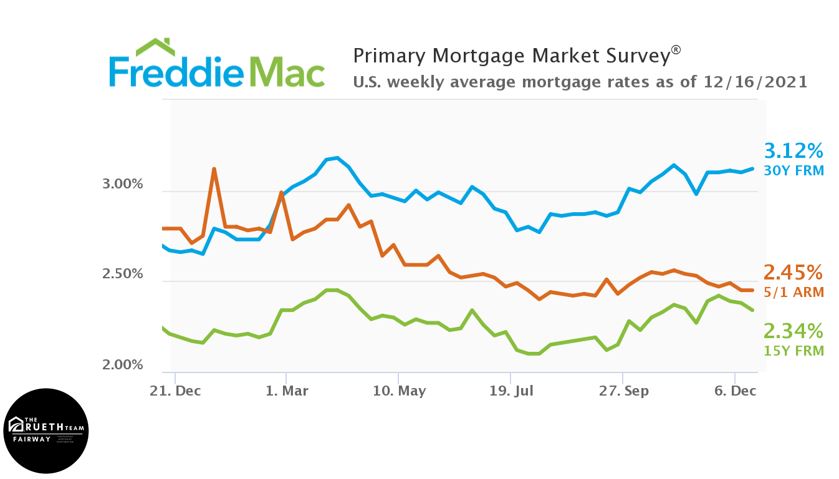

Bottom line… mortgage rates will go up.. but, how much? My guess is 3.625% by end of 2022. Some economists think we might see another recession in 2024. Ivy Zelman, a housing data analyst, thinks we will see an oversupply and home prices go down. Anything is possible when looking into the future, especially with technology advances moving money and markets faster than ever before. But the Fed raising the Fed Rate three times.. that alone won’t raise the 30 year fixed mortgage rate. That I know to be true!

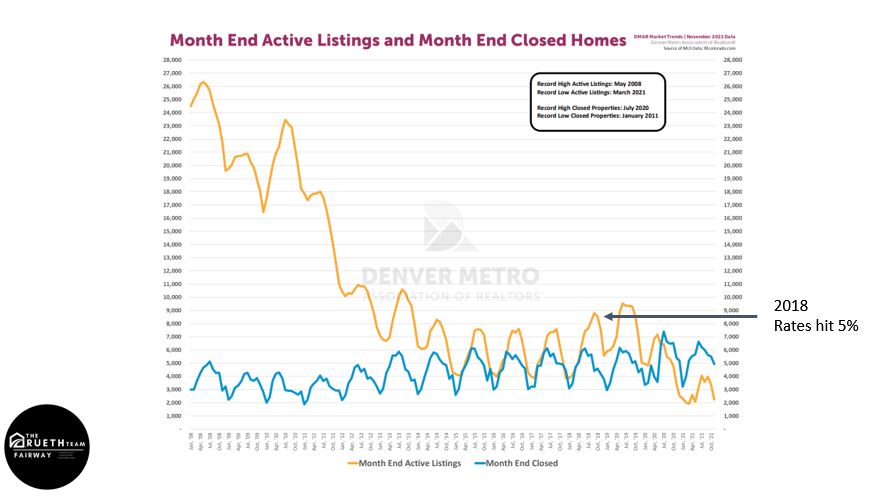

Inventory ONLY Went Up 1,000 When Rates Popped Up To 5%

As interest rates go up, affordability will be challenged, buyers will be less willing to buy high, which will soften pressure on inventory … slightly. 2018 saw a spike in rates, the 30 year fixed rate went up to 5%. Inventory in the DMAR 11 county area went up, yep, slightly. We saw active inventory increase from 7,589 in 2017 to 8,539 one year later in September 2018. Inventory hit 9,286 one year later in the Fall 2019 as rates dropped to 3.5% and the economy was on Recession Watch. Closed Homes remained the same all three years even while buyers took advantage of the little inventory to choose from. So .. rates popping up to 5% increased inventory 13% or 1,000 units. When talking small numbers, the percentages seem higher. What I would give for 1,000 more units on the market today… which we both know, would get scooped up in a weekend or two. Not exactly shifting us to a buyers market.

The Bottom Line:

While rates should and probably will go up this year, a softening of the market is not expected until supply chains loosen, builders make up for lost time, and the economy starts to drag. Even then, my money is betting on the fact that they can not build land anymore and single family homes (and the land they sit on) will always be worth more tomorrow than today.

[author] [author_image timthumb=’on’]https://www.theruethteam.com/wp-content/uploads/2020/11/testimonial_image.jpg[/author_image] [author_info]Nicole Rueth has been passionately advising clients on their wealth building and home financing strategies for over 17 years. Her path has been non-conventional and it is a benefit to her clients. www.TheRuethTeam.Com.[/author_info] [/author]