Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Everyone Else Is Too Scared

Buy When There’s Blood In The Streets

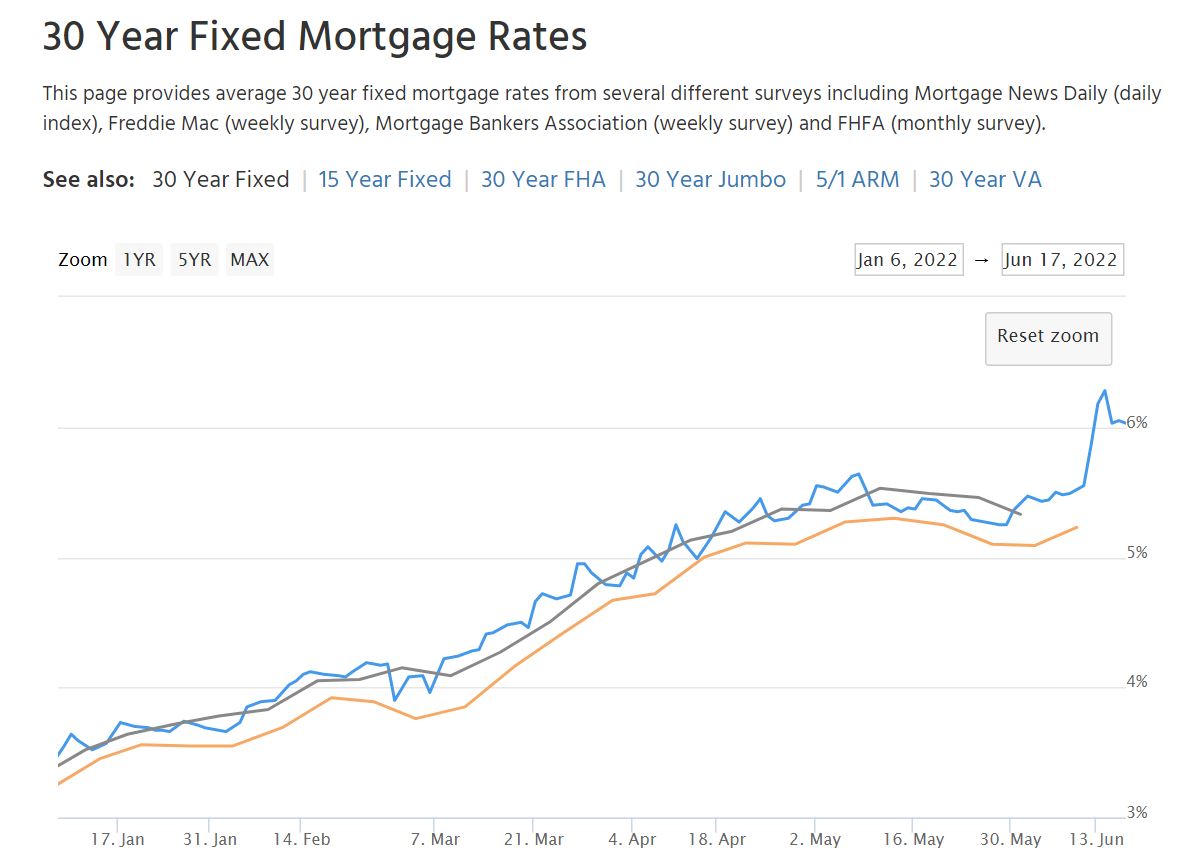

Barron Rothschild said “the time to buy is when there is blood in the streets”. He should know, the Baron was a British nobleman who profited from the panic that followed the Battle of Waterloo against Napoleon. I’m not going all in on blood in the streets, because you know how positive I am on housing… but the next year is going to bring challenges, fear, and a bit of the unknown. The Fed leaked to the press days before raising the Fed Rate by .75% to try to calm the market. Yet, our markets are not local, their global. And, while Powell quietly leaked the .75% raise, other global markets did not do the same. The Swiss National Bank and the National Bank of Hungary both caught markets off guard with big upward steps, the Bank of England came in with an expected .25% and the European Central Bank called an emergency meeting. These movements brought continued unease to the markets. After our brief celebration for Powell’s overdue aggressive 75bp Fed Rate increase aggressive, the global markets took back some of the DJIA gains and continued it’s path to volatility.

Volatility will continue to define 2022, stocks, crypto currency, mortgage rates, all are reeling from the changes. Volatility kills returns. But here’s what I know. As mortgage rates are impacted by volatility, real estate values will keep going up. Hopefully more slowly than it has been.. but even during the 1978-1982 stagflation period, housing went up 1% a year. I would LOVE a 1% appreciation in 2023. It would tell me we are on the path to normal, giving buyers opportunities to get into the market and giving sellers a fair return.

Do your buyers know the opportunity they have in today’s market? Can they look past the fear and find the opportunity? This weekend, a holiday weekend, might be the very weekend they find success.. but are they out there looking for it? Rates are high.. I get that. Every news cycle wants to emphasize that affordability is off the charts and payments are higher with prices and rate. BUT… we are seeing more homes sitting on the market for more than a weekend. Lawrence Yun was just quoted noting as inventory returns to pre-pandemic 2019, homes remaining on the market more than a month might be common again. So buyers have choices and negotiating power. He also noted that rental demand and rents will strengthen as would be buyers chose to rent. I am afraid we have not seen the top in rental rate increases yet.

ARM Rates

The 10-year Treasury dropped from it’s 3.49% peak, but don’t celebrate just yet. With the Fed not sure if they are going to land at .5% or .75% at their July meeting, add a August meeting, or be able to offset the geopolitical influences affecting our market, we can expect rates to stay volatile for the time being. The 30-year fixed is currently hovering around 5.99%. However, ARMs are giving the buyer who is comfortable with the risks a little wiggle room. We are seeing rates ranging from 4.75% to 5.625%. Options.. it’s all about options

Homeowner Equity Insights Released

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties*) have seen their equity increase over $3.8 trillion since the first quarter of 2021, a gain of 32.2% year over year. WOW! Those homes who do have negative equity dropped to only 2% nationwide or 1.1 million homes.

Denver has only 1.3% and Colorado 1.5% of homes underwater (or negative equity). Coloradoans gained a whopping $92,000 on average in home value from Q1 2021 to Q1 2022.