Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Build to Rent is Solving the Affordability Crisis

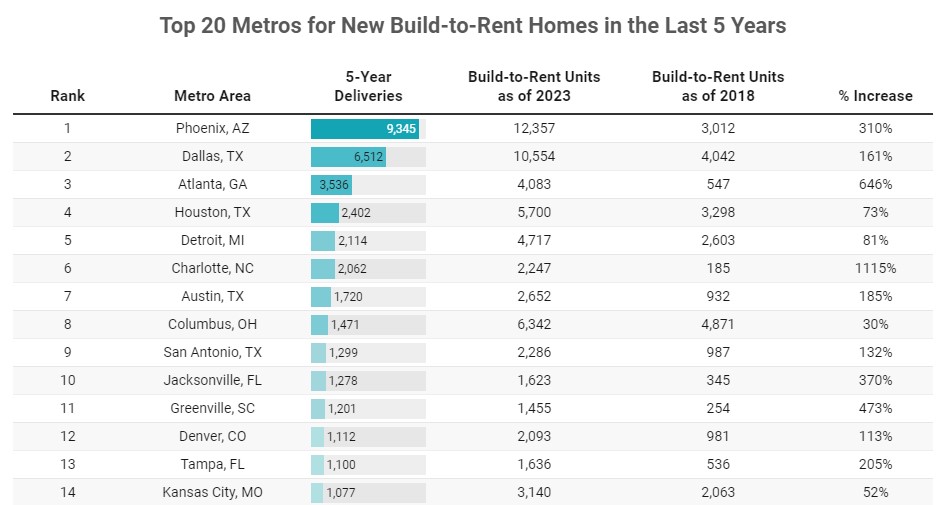

Denver Ranks 12th in the Nation: Build to Rent

The lure of build-to-rent options is appealing for some homebuyers for a number of reasons… lower monthly cost than buying, less money out of pocket at onset, and more space than apartment living. As a potential buyer in today’s market, higher home prices and interest rates makes buying a challenge and this new trend might just be the answer. In fact, you might be shocked at how much build-to-rent is happening right now, giving your potential buyers a strong alternative.

Looking only at communities with 50 or more units (which excludes all of the smaller 8-49 unit projects happening right now), RentCafe counts nine projects with 1,618 homes under construction along the northern Front Range. And another 11 communities with 2,247 homes in the planning stages.

Among the larger BTR projects are the Fillmore at Copperleaf in Aurora with 229 units, set to open in November 2025, and Vella Terra in Loveland with 240 units, set to open in April 2025.

Planned projects are even larger. Brookfield Properties’ 39th Avenue in Denver is looking at 492 homes south of Denver International Airport. EX5 Management is looking at 630 units at its Spring Hill development in Erie on County Road 3 and Colorado 52.

While Denver did not rank in the top 20 for BTR units completed in 2023; we did place #12 for the number of deliveries in the last 5 years. And based on the 1,618 homes currently under construction, that number would have put us in forth place nationwide if they completed last year.

* Note, this example assumes a 7.5% rate for the full 9 years… which is highly unlikely, but anything’s possible.

Across the United States, 27,500 homes for rent were completed in 2023, 75% more than in 2022. This momentum is only growing with 45,400 BTR homes now under construction solving homeownership’s affordability challenge.

But does it solve America’s Wealth Gap?

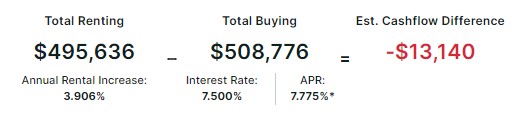

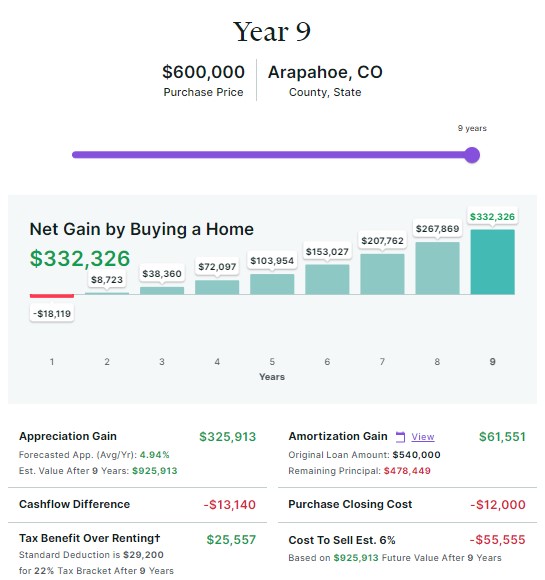

Continuing this example, after 9 years if this renter stood next to this homeowner, with the most conservative of assumptions. Upon sale, the homeowner would have a Net Wealth of 332,326. There are times when renting is absolutely the answer. Then there are times when today’s decision, despite all the obstacles, impacts a family in a way no other moment could.

If you want numbers run for your client, farm or sphere; reach out and let’s do this. Let’s continue to educate and inspire, fighting the tendency to stop at the most obvious answer today for the one which will produce so much more opportunity when looking further out.