Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

13 Reasons The Housing Market Remains Strong

Just The Facts Ma’am

| Buyers are entering into a time when they have an incredible advantage. But it doesn’t feel good. It feels unaffordable and even unsafe. I’ve had a number of real estate agents reach out asking .. how do I talk to my buyers who are scared in this market?

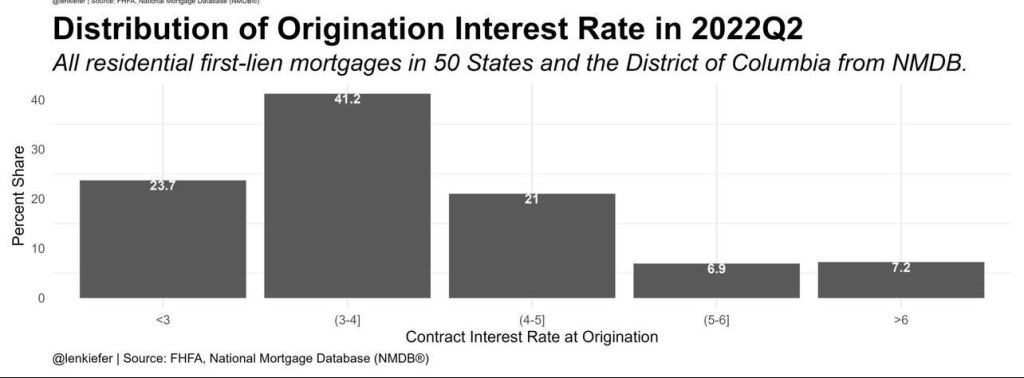

First, with empathy. It is scary. We’ve seen home prices escalate 44% with intense buyer bidding, insatiable demand, and limited supply. Then saw it turn on a dime as interest rates spiked. Now as home prices “fall”; buyers are tempted into waiting for the bottom. While they are waiting inflation numbers are starting to soften, the Fed is starting to near it’s peak, the economy shows signs of slowing. All of this to say, a recession is coming. Recessions bring lower inflation, lower mortgage rates, and higher home prices. Especially this one. Because this upcoming economic recession and the housing recession we are in, isn’t due to credit deterioration (like it was in 2006-2008), it’s about affordability. Affordability which will loosen a little as rates settle back down. After lots of empathy, you need to be armed with facts. Facts which help assess the real risk. How stable are jobs, credit, households? Will homes go into foreclosure dropping prices and toppling the market? The short answer is.. American’s are strong financially and home equity protected. The longer answer.. is in the 13 facts below. Here are some ditties to support your next conversation: 1. 38% of all homes are paid off nationwide (Per US Census Bureau). In Colorado it is 29.2% or one out of every 3.5 homes are owned free and clear per CDOLA. 2. Another 26% of homes purchased in October were paid in full with cash. Those purchased with a mortgage had a credit score of 723 3. October 2022, Colorado made the “bottom 5” states with a 2.05% 30 day mortgage delinquency rate, less than 0.5% off the all time record low. (Blackknight Mortgage Monitor) 4. 2.91% of all homes with a mortgage nationwide are in delinquency. (Blackknight) 5. 0.35% of all homes are in foreclosure nationwide 6. Americans are still sitting on $1.7T excess cash (Axios) supporting a strong economy 7. NAR lists the current inventory at 1.22 million, still below 2019 and half the historical normal of 2 million to 2.5 million. 8. 77% of older adults want to age in place (AARP)… reverse mortgages will continue to let them and put pressure on limited inventory 9. Redfin continues to show strong investment purchase numbers.. . 17.5% all purchases in Q3 ’22.. showing their hold on inventory. This is down from 19.5% showing “investors pulling back”.. however, it is still up from the 15% pre-pandemic. 10. 86% of all mortgages are locked Under 5%; 65% are locked under 4%. Keeping sellers (i.e. would be buyers) locked into their homes with low rates and low mortgage payments; again.. keeping inventory low. In Colorado.. 91.8% of our homes are locked in UNDER 5%! WOW |

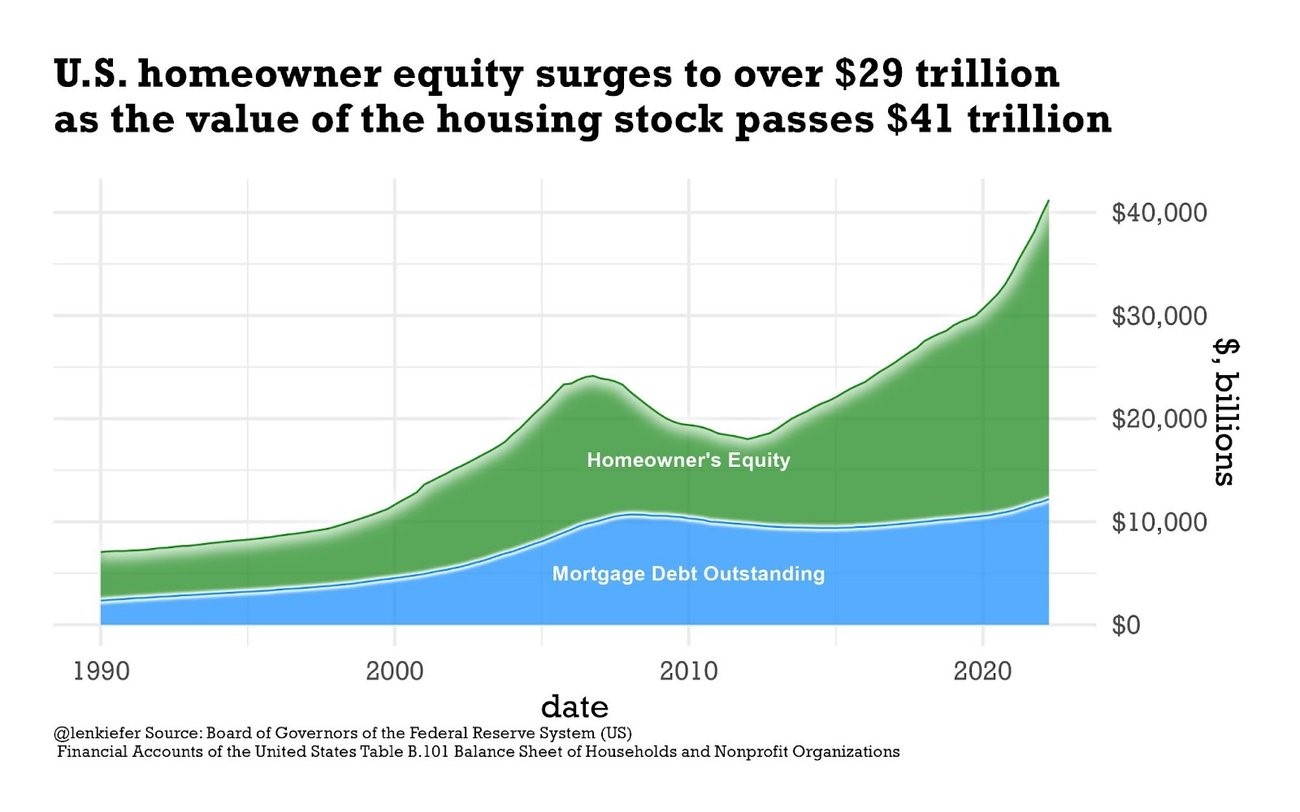

| Bonus #11: There is over $29T in equity in American’s homes. With all housing stock worth $41T and mortgage total balances equal to $12T… America has a 29% loan to value… that’s super low and provides a substantial equity cushion, even as we lose some home value. Side note.. there is over $16T in equity in homes which are mortgaged (remember almost 40% are without a mortgage). |

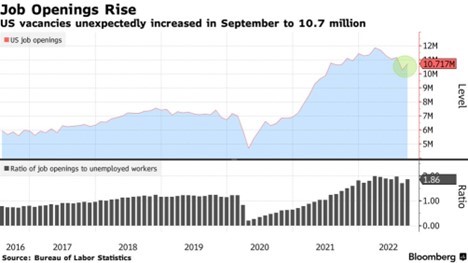

Bonus #12: Job openings continue to blow past estimates at 10.72 million openings for October or 1.9 job openings per worker with an annual wage increase of 4.7%. This will keep initial jobless claims in check as homeowners are often gainfully employed with a fixed mortgage debt payment.

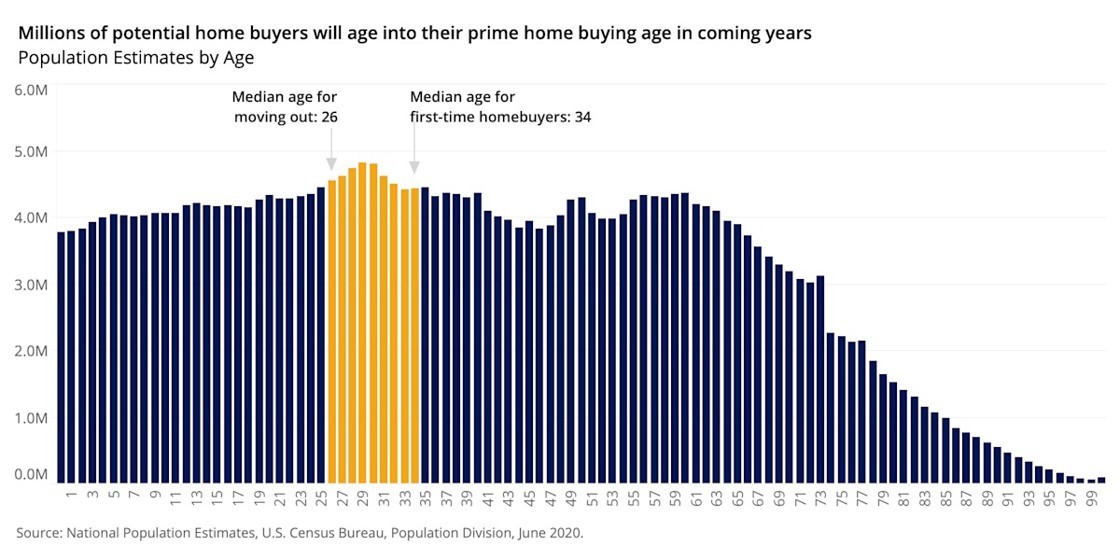

Bonus #13: Demographics Win! Affordability will continue to hurt first time homebuyers; but with a massive generational wealth transfer on the horizon and wages continuing to increase; you can’t deny the largest age group their drive to homeownership. This demand will not simply go away due to home prices. This will also continue to put pressure on limited inventory.