Rates Dropped Before the Fed EXPLAINED If you're thinking about buying a home, you've probably…

Home Buyers Win THIS Weekend

“Our debt to the heroic men and valiant women in the service of our country can never be repaid. They have earned our undying gratitude. America will never forget their sacrifices.” – Harry S. Truman

Home Buyers Win THIS Weekend

Some sellers held off from listing this holiday weekend, but those who put their house on the market are giving buyers an opportunity they have not had in a while!

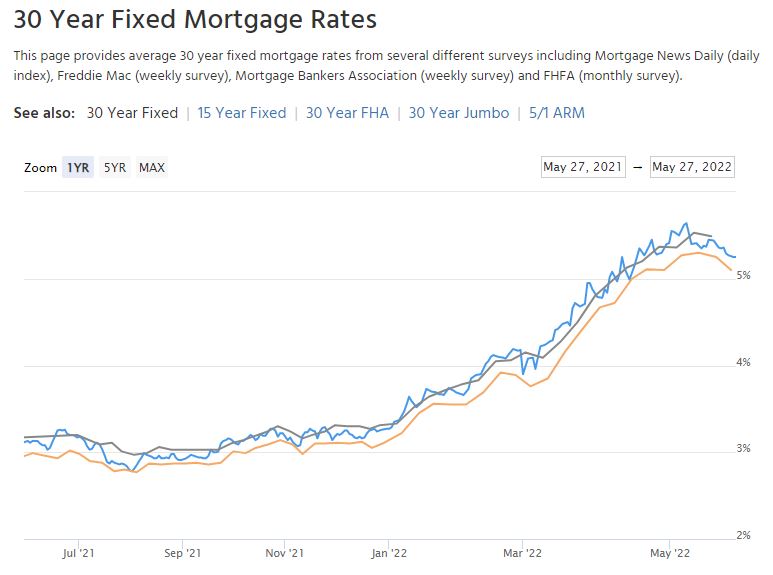

Lower Rates

This is not a new trendline but a relief from 10 weeks of higher rates. On Friday’s Market Update I showed how the current spread of the 10-year Treasury and the 30-year fixed is 2.34% today whereas historically it is closer to 1.65%. Much of the increased spread is due to market risk, limited investor purchases on the secondary market (now that the Fed has pulled out), and pricing adjustments with Fannie Mae and Freddie Mac. We are seeing better rates today with Jumbo loans, which is atypical, giving clues to the need for the 30-year to pull back slightly. Rates will continue to be volatile as inflation remains high, the Fed kicks off quantitative tightening, geopolitical actions restrict supply chains. However, it appears the speed train to higher rates might have slowed down, giving buyers a little breathing room.

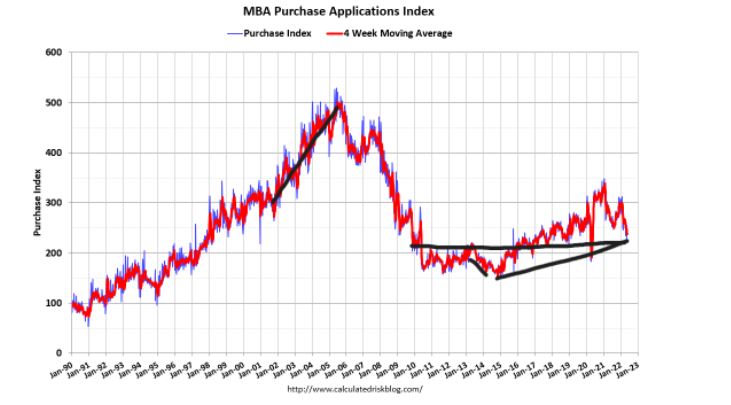

Less Demand

Mortgage Applications were down 1.2% this week after being down 11% last week as well as 9 times out of the last 11 weeks. Mortgage “Purchase” Applications were flat this week but down 16% year over year. The affordability of higher interest rates plus higher home prices has certainly slowed down the insatiable demand we’ve seen over the last two years. We’ve all heard “high prices is the cure for high prices”. Demand slowing will slow showings and the number of bidders per property. This is especially good news for buyers who have been pushed out for the last two years trying to use an FHA, VA or DPA loan!

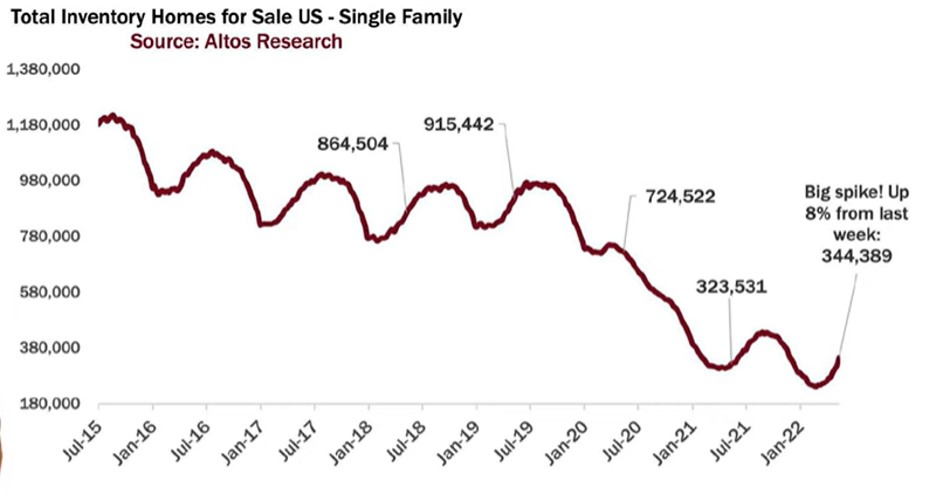

More Inventory

Week over week, nationwide inventory ticked up 8%. Locally the average daily active count increased 7%. A little more inventory with a little less demand gave buyers an extra day on market. Whew!

Slowing Is A Good Thing!

Some buyers will worry about the market slowing.. I get that. They will think that it will slow so much prices will come down. And maybe in some local areas that’s right. But, here are a few facts to remind them how strong our real estate market really is and why they need to get in sooner than later!

- The average loan to value in all US homes is 31%; including 40% of all homes which have no mortgage. No one will have to sell at a discount.

- Only 1.7% of all Colorado homes are delinquent and .1% are in foreclosure.. again, talking to the strength of our housing stock.

- 18.4% of all purchases 4Q2021 were investments. January 2022 saw 33% of solds went to investors. They know what the rich know (see last week’s blog).. that real estate is the ultimate hedge to inflation and most secure way to offset market volatility, especially given the power of leverage.

- On average, the Denver Metro has 14,596 homes for sale (1985-2021) in April, 2022 had 3,204. (per DMAR); still extremely far from “balanced”

- Denver Metro has gained 123% in home value since the peak home prices in 2006 and after the recovery from the largest housing bubble in history (per FRED)

- We have the strongest historic buyer profile today with only 22% of all buyers having a credit score less then 700. In April, Denver’s average buyer had a credit score of 741 and put 24% down on their purchase.

- Out of the last 30 years, Denver only lost value 4 years: 2.6% in 2007, 11% in 2008, 3% in 2009, and 1% in 2011. On average Denver gains 7.5% a year in home prices.

- Home ownership builds wealth through appreciation, principle reduction, and tax advantages. So even if some of the appreciation is lost, other financial advantages still exist.

- But in my opinion the most important fact is this…rents are up 15% year-over-year for Denver Metro April 2022.